A recent study conducted by Epsilon revealed that direct mail influences holiday purchases for 77% of shoppers. By comparison, just 41% of respondents say online banner ads influence their decisions. #DirectMailWorks

Author Archives: bebtexas

HAPPY ROSH HASHANAH

The Mailbox Isn’t As Crowded As Your Inbox

WE REMEMBER

TOP SMALL BUSINESS CHALLENGES

Each year, Guidant Financial surveys over 1,000 small business owners and publish their findings in The Small Business Trends Report.

Topping the list? Recruiting/Retention and Inflation/Price Increases.

The younger generations entering the job market have different priorities and DEFINITELY have different expectations. They want more flexibility, work-life balance, and a sense of purpose in their work. Many want to work from home, which is a real challenge in the manufacturing environment.

DIRECT MAIL MARKETING IS HOT!

- 64% of consumers say that direct mail inspired them to take action, including exploring websites and making a purchase

- 74% of marketers agree that direct mail provides the best ROI of any channel they use

- Over ½ of consumers share their direct mail

- 55% expect to receive personalized direct mail from companies they buy from already

ROI – A Summer Camp Direct Mail Success Story

We have a local stables as a client. We manage their website, do their social media and email marketing, and supply them with signs and other printing. They asked us to help boost sales for their summer camps and we turned to direct mail for the answer.

We have a local stables as a client. We manage their website, do their social media and email marketing, and supply them with signs and other printing. They asked us to help boost sales for their summer camps and we turned to direct mail for the answer.

First we pulled a list within a 5-mile radius of the stables. We selected families with a presence of children aged 5-15yrs, and an annual household income of $175K +. That netted 2,585 addresses.

We created a 6X11 postcard highlighting the camps. Camps are sold for $499 per child. Cost to purchase the list, create, print, and fulfill the mailing, with postage totaled $1,200.00. Our client received 19 summer camp registrations from the mailer, that totaled $9,481.00 in sales. That represents a 790% Return. No matter how you look at it, Direct Mail Works.

Memorial Day Weekend

JULY 2023 RATE INCREASE FIRST CLASS COMPARISON CHART

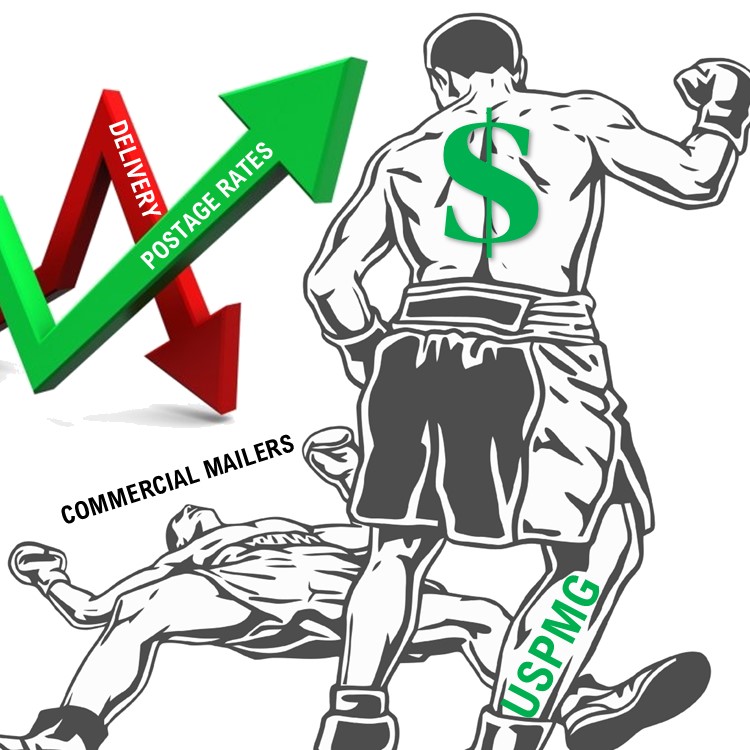

The USPS has requested another rate hike to take effect on July 9th. Click below to see a rate comparison chart of current first-class rates compared to the proposed rates.

JULY 2023 POSTAL RATE COMPARISON-MARKETING MAIL

And the industry takes another hit from the USPS with the second rate hike of 2023. See below for a chart showing current postal rates compared to the proposed July 9th rates for marketing mail.